The importance of offering a range of payment methods in your eCommerce store is becoming increasingly more important to meet the needs of the ‘instant gratification generation’. Choosing and offering payment methods your customers want to use is one of the most crucial elements of the customer journey and one of the most direct ways to impact your conversion rate.

All your hard work towards brand awareness and customer acquisition pays off at the checkout stage, so you want to make the payment process as simple and seamless as possible. Any friction within the payment process increases the likelihood of a lost sale.

A study by the Baymard Institute found…

“28% abandon their cart due to a long or complicated checkout process whilst a further 8% abandon their cart due to not enough payment methods being offered.”

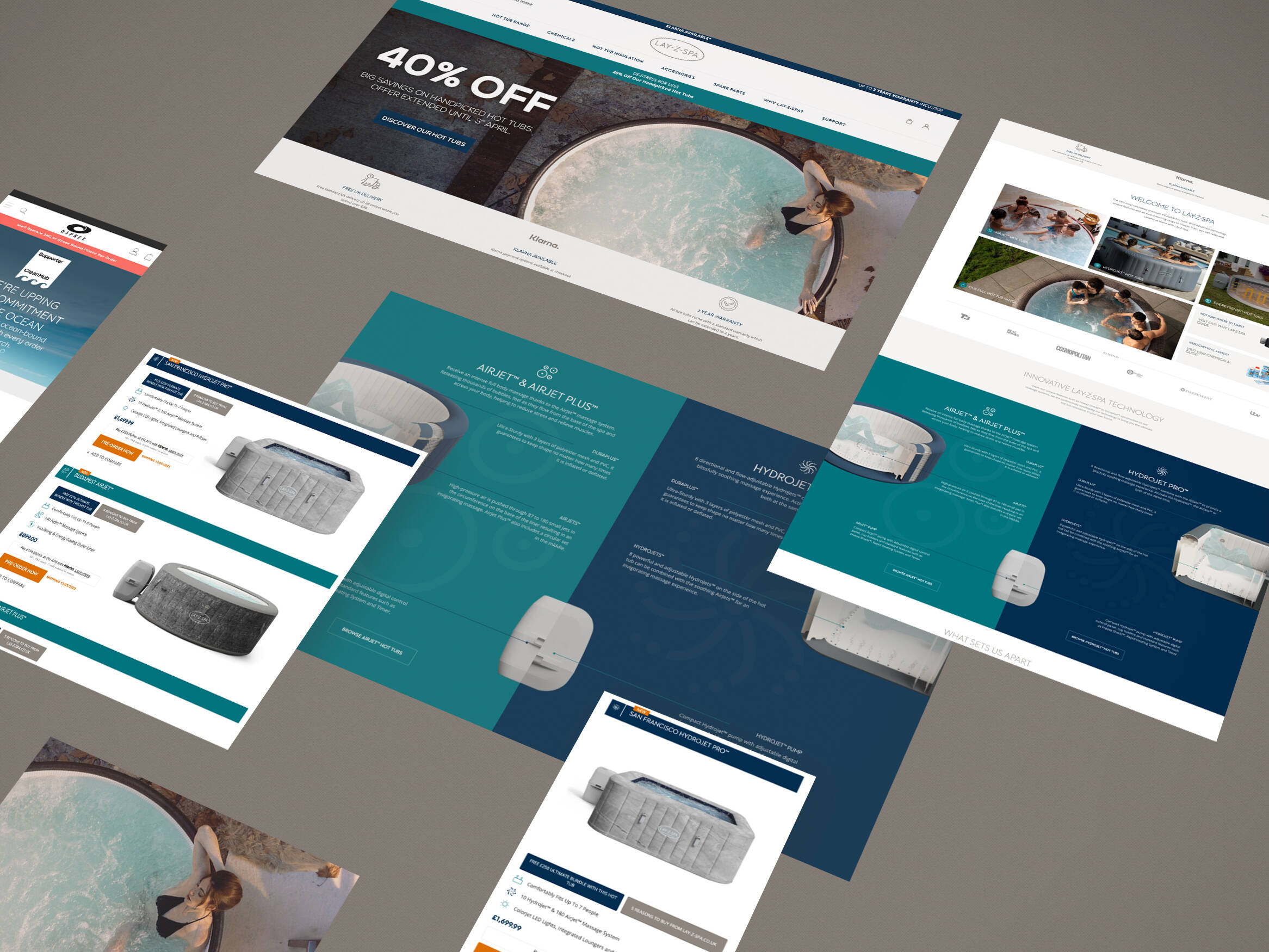

One of the newest, yet fastest growing payment methods makes optimising conversions at this critical stage effortless. New ‘buy now, pay later’ solutions like Klarna allow shoppers to buy and receive their products, then pay for the purchase over time.

Read on to learn what ‘buy now, pay later’ is and three reasons you should consider offering a ‘buy now, pay later’ payment method to your customers.

What is ‘Buy Now, Pay Later’?

‘Buy now, pay later’ is a flexible payment method that allows your customers to make a purchase when they may not have the funds at that time. They can then pay for their goods flexibly – and interest-free – either within a 14-day window, 30-day window or in instalments (dependant on the store).

This new payment method offers a simple alternative to credit cards, which have the potential to quickly rack up interest and fees. Instead, most ‘buy now, pay later’ providers run a soft credit check to ensure eligibility and don’t charge interest rates making it super easy for customers to make them their payment method of choice.

Klarna are the leading provider of ‘buy now, pay later’ services, partnering with retail giants like ASOS, Schuh and In The Style to name a few.

Using Klarna at checkout, Schuh increased their conversions on mobile by 40% and by 25% on desktop.

In The Style saw Average Order Value increase by 31% after implementing ‘Pay Later’ from Klarna.

Klarna integrates seamlessly with Magento eCommerce stores. Get in touch if ‘buy now, pay later’ is something you’d love to offer your customers.

Klarna integrates seamlessly with Magento eCommerce stores. Get in touch if ‘buy now, pay later’ is something you’d love to offer your customers.

This new payment method is taking the world of eCommerce by storm, with more and more retailers seeing its benefits and choosing to offer it to their customers. Let’s take a look at three reasons you should consider ‘buy now, pay later’ as a payment option for your eCommerce store…

3 Ways ‘Buy Now, Pay Later’ Can Boost Your Business

1. Increase Your Sales

Adding a ‘buy now, pay later’ payment method to your checkout means customers can see and try products before paying for them. It means shoppers are able to pick up a product in multiple sizes or colours without the worry of the money leaving their account until they’ve decided what to keep.

It also means that even in the run-up to payday where, typically, shoppers may be short on funds, they can still shop and pay for their purchases once they have the money.

Offering your customers more ways to buy from you means you generate more sales and satisfy customer needs.

A recent study from Klarna saw retailers boost their sales by adding ‘pay later’ to their checkout:

- 15% increase in average order value

- 20% higher annual customer purchase frequency

- 7% higher conversion rate vs. card transactions

2. Convert New Customers

So much time and effort goes into the acquisition of new customers, so make those efforts worthwhile by giving potential customers the options they want, when it counts – at the checkout.

You can have the best SEO strategy or social media campaign bringing new customers to your site, but if the checkout process isn’t smooth or doesn’t offer a range of payment methods, the likelihood of these prospective customers converting isn’t high.

Offering a range of payment methods including an alternative payment method like ‘buy now, pay later’ can make all the difference and encourage new customers to make their first purchase with you.

“The unexpected bonus with Klarna is that it has attracted new customers, who had never shopped at Finery before. Klarna users have also shopped 8% more frequently than other card users, meaning they are spending more and increasing Finery’s loyalty statistics.” – Finery

By offering ‘buy now, pay later’ many retailers also see an uplift in returning customers. Since EGO Shoes started using Klarna in their checkout, they’ve seen a 42% increase in returning customers.

3. Reduce Cart Abandonment

Cart abandonment is the achilles heel for most online retailers, with a staggering average cart abandonment rate of 69%. The key to reducing cart abandonment is to minimise the number of interruptions, add more payment options and reduce pain points to create a smooth checkout process.

Implementing ‘buy now, pay later’ means you’re offering your customers an extra way to pay, alongside the usual debit or credit card, PayPal and Apple Pay options.

A smooth checkout with a range of payment methods is vital to converting your potential customers into revenue; a study from Klarna found that up to 45% would abandon their basket if they found the checkout process too long. By offering a range of payment methods, including ‘buy now, pay later’, you’re giving customers little reason to abandon their cart.

Klarna helps reduce the number of steps and complexity of the checkout process by prefilling users details after they’ve used the service once.

“At Klarna, we say the less forms, the better, to avoid collecting unnecessary customer information that delays a purchase. Our ‘buy now, pay later’ options deliver a better checkout experience and a smoother outcome.” – Klarna

To Conclude

The payment process is a crucial part of any eCommerce site and its even more important to provide a range of payment methods for your customers. Choosing the best payment methods for your customers to create a seamless checkout is vital to running a successful eCommerce business.

‘Buy now, pay later’ is one of the fastest growing payment methods. Hopefully, you now know why it has become so popular and how it could benefit your eCommerce business.

Klarna, the leading provider of ‘buy now, pay later’ are one of iWeb’s fantastic technology partners – meaning we can help you integrate Klarna on your site. Get in touch and our team of experts will be happy help you get started.

Get in touch

We know commerce, let us help you improve customer experience, increase conversion rates, and make that digital change.

- hello@iweb.co.uk